Money Supply and Relativity

Money Density

Studying the money supply of an economic zone as a global figure is not enough to certify that the money is correctly created or not.

Indeed, if we can in some circumstances note that a certain money supply grows at a steady and constant pace, its non symmetric creation density in such or such economic sub-part would violate the ethics of the set of solutions of the “Three Producers Problem” when expanded to N citizens of the economic zone.

Non-symmetric monetary creation density issues are essentially due to the hoarding by a subset of citizens of the monetary creation through a biased application of creating value, and is being done at the expense of all present and future actors, in terms of both “first choice” and “value judgment”.

Global monetary information publication should therefore be completed, for an efficient citizen control of monetary ethics, by information relative to the spacial density of the creation of that money, knowing that this density should be well balanced.

Therefore in France, it is because the monetary creation is essentially concentrated around Paris that the economy is ostensibly the most flourishing, and that the population flows are condensed there. The same reverse monetary creation realized in another city during the same period of 50 years would produce without doubt a similar result (always at the expense of other cities).

Growth

Let “c” be the measured growth of the money supply. Besides, what is called “economic growth”, within the meaning usually given to GDP, fundamentally depends on “c”. But it is the uncertainty about “c” in the economies falsified by arbitrarily created “debt” money, which generally destroys growth by disorientating the individuals regarding the efficiency of their currency.

It is a fundamental error to estimate the “growth” using the GDP, which measures exchanges of values. In fact, growing the money supply, if it is dense enough at all in the economy, will have as effect, considering a constant production, to mechanically rise prices, without any effect on the quantity of exchanges, the costs being generally impacted and following the rising prices, but not at the same time, so this will rise the GDP, even if the exact same goods and services would be produced and consumed from one year to another.

It is also possible to see GDP rising at lower production and lower exchange levels, if money is created in a sufficient and significant proportion to compensate.

“Growth” from the “GDP” point of view is therefore an absolutely biased notion, whereas the growth of the money supply represents a perfectly sure, known, and verifiable information and does not depend on the chosen frame of reference to measure it unlike all other estimations.

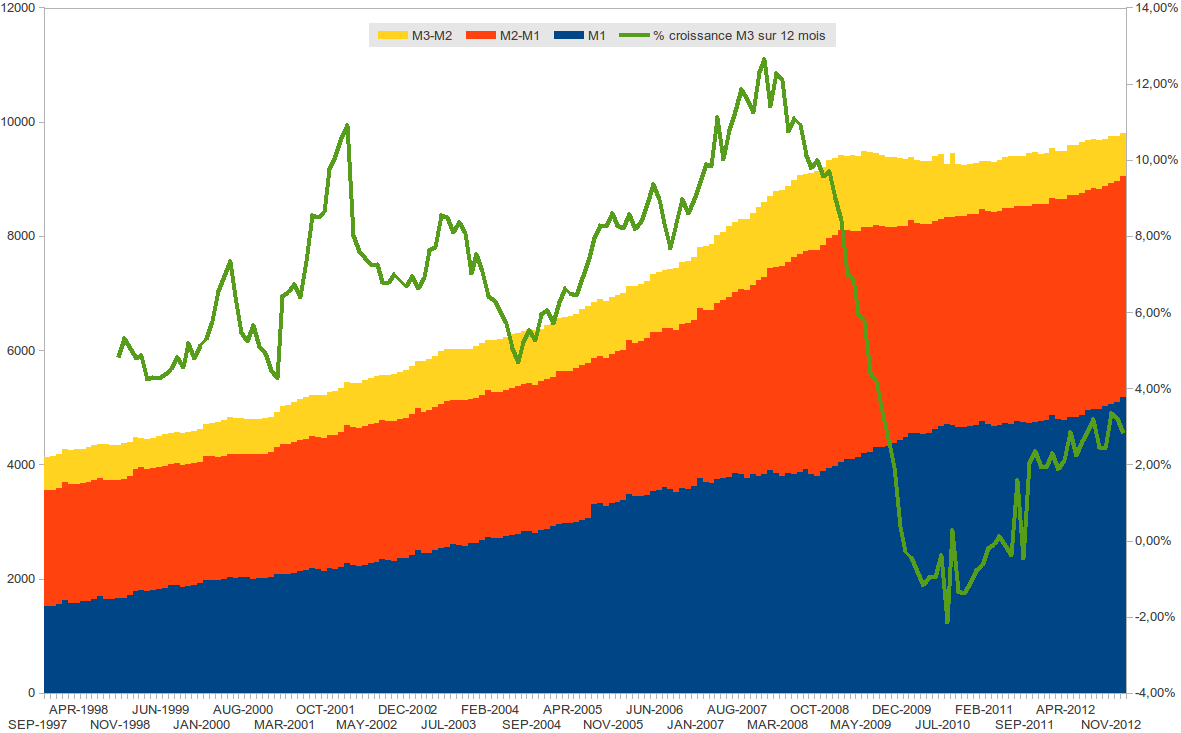

The following graph shows the whole money supply M3 consisting of M1, (M2 - M1) and (M3 - M2) of the Euro Zone from 1997 to October 2012 in quantity as well as in growth on 12 months (ordered by % on the right). The growth in Euros from 1997 to 2007 has reached on average 8% per year, with a distribution within the 330 millions of citizens in the economic zone, of the excess of common money that was not published and certainly not uniform.

This monetary creation essentially benefits States and big companies even if they produce obsolete values and without interest for 90% of the population with production processes that are most of the time outdated and extremely expensive. This system only favors some privileged individuals, and encourages incestuous speculation between Banks. The winner hoards his earnings, and the loser goes bankrupt, establishing thus at the end of the operation a central and unbalanced monetary creation.

While money is an immaterial and a common tool to exchange productions in an economic zone, it is used to hold a power linked to the capacity of depriving the sovereign citizens from the exchange tool while forcing them to use it (particularly to pay under duress taxes and interests from credits in a currency whose emission is otherwise controlled).

And yet, it is obvious that the only decision to stop allocating additional credits to a pseudo-isolated economic zone, brings it to the mechanical incapacity (and not fundamentally productive) to repay capital and interests “in the currency”. How do we make sure we will be able to pay with something that we don’t produce ourselves? The asymmetric money producer is taking the easy way out by defining and producing itself exclusively and therefore at the expense of others which acts as measuring value!

“Growth” measured relative to GDP can be a total lure. The only growth is that of the money supply, which accompanies with a delay effect the growth in monetary terms of monetized economic exchanges, regardless of their relative form in space and time.

There is then an unacceptable scientific bias to perform measures thanks to a tool for which the experimenter chooses the settings according to his goodwill, and without considering his modifications in his results other than its subjective choices.

Purchasing Power

Si l’on tient compte de la croissance de la masse monétaire, on ne parlera plus de pouvoir d’achat d’une quantité donnée de monnaie sans la mettre en rapport avec cette même masse. On parlera donc de potentiel d’achat. Le biais qui consiste à définir le prix d’un « panier de biens » arbitrairement défini comme mesure du « pouvoir d’achat », revient à définir un pouvoir d’achat intemporel dans lequel en toute honnêteté on retrouverait alors en 2010 des quantités de « poules au pot Henri IV », « Fiacres 1900 », « formation à l’art subtil d’alchimiste » ou autre « livre produit par les moines copistes ».

Du point de vue de la Théorie Relative de la Monnaie, on ne peut que refuser d’accepter une telle méthode, basée sur des valeurs « absolues » quand bien même elles seraient revues et actualisées, car elles seront toujours sujettes à des choix arbitraires.

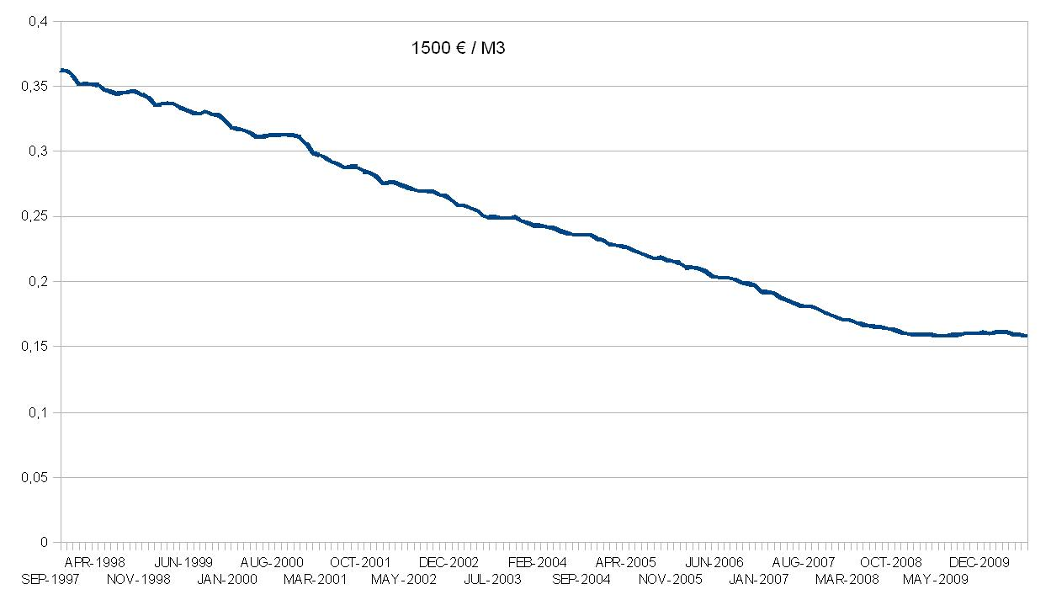

The following graph represents a 1500€ “fixed” salary evolution relative to the money supply of the Euro (expressed in billions of euros) from 2000 to 2010, and therefore to the purchasing power.

Purchasing power of a fixed salary has fallen more than 50% between 2000 and 2010. In other words, it is likely that the prices of a majority of goods whose demands are “relatively stable” between these two dates has risen more than 100% on the same period. It is rather surprising to see how the lies about measures that are verifiable can be spread within democracies where the media power is expected to represent the guarantee of transparency.

The Relative Theory of Money does not say that a “salary” should follow money supply inflation, that is in fact impossible, the highest salaries would be favored and would participate to an increase of the money supply greater than the balance rate! Moreover, nothing ensures that a given production will be exchangeable against anything tomorrow, this depends on individual and collective choices which change over time.

The Relative Theory of Money says that this is the Universal Dividend, and only that, which is indexed on the money supply, and which ensures that monetary basis is symmetrically distributed, and therefore compatible with the three fundamental economic freedoms.

It also says that we should correctly measure economic scales with relative data, taking into account the quantity of the existing money supply per citizen within the economic zone, so that the economic actors could make their choices wittingly and according to their individual point of view.