Value Field

Fundamental Equation of the Value Field

Considering what has been previously established, we have on every point “x” of the economic space and at a time “t”, a production Cx, associated to a price Px, as well as a flow of incoming or outgoing production (positive or negative) Cfx associated to a price Pfx, together with a created money on X dMx and a flow of incoming or outgoing money (positive or negative) dMfx.

In the case where the money represents exactly the produced or exchanged value we have:

But as otherwise this equality is true only exceptionally during immediate exchanges or productions, we call J the field which is generally different from zero, defined on every point “x” of the economic space-time, by:

dMx represents the Universal Dividend, Px × dCx the potential of individual value (the economic innovation share of each individual), while dMfx represents the local flow of the pre-existent money supply, and Pfx × Cfx the local flow of exchanges (positive if it increases, negative if it decreases).

The differential value field is dynamic, evolves in time, and measures thus at each point of the economic space, the differential of created money and of the value created by the individual “x”, added to the part of money and the global circulating value to the “x” point.

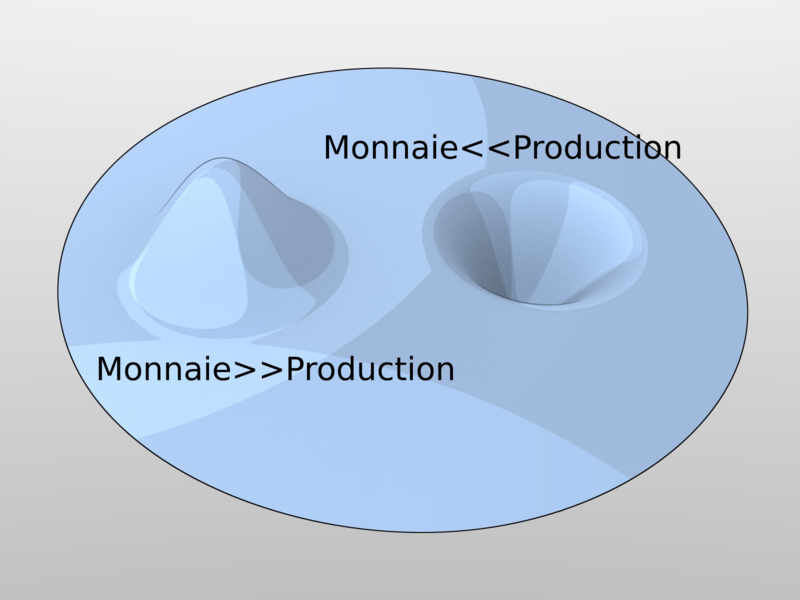

The resulting field of its integration “J(t)” will show positive bumps where we will find surplus of money compared to the local potential worth of the effective production of goods and services. On the other hand, it will be hollow where the local potential worth of production exceeds the quantity of money present. This quantity can be negative if there is emission of debt.

Example of field for an economic zone including an area of monetary excess shown by a bump, and a zone where there is a production of value associated with a monetary scarcity represented by a hollow, the rest of the area being balanced.

Economic value is relative to the observer who is measuring it (to the actors who are exchanging it), so we should talk about “local potential worth of production” rather than “absolute value” that would be recognized by all the actors of the economy, which doesn’t make any sense in the “Relative Theory of Money”.

If these two are are slightly isolated within the economic zone, and produce the same goods and services, there will be high prices in one and low prices in the other, only because of this distribution of monetary density inside this economic zone.

NB: Yoland Bresson defines the value field like

where K represents the time standard (the Universal Dividend), M the money supply, P the production and C the economic exchanges. The value field is then without any dimension. Both definitions are very close, because they are based on the same values, and both taking into account the local and global measure inside a differential equation. I distinguish, in order to be more precise, the production from the money created locally and the one exchanged.

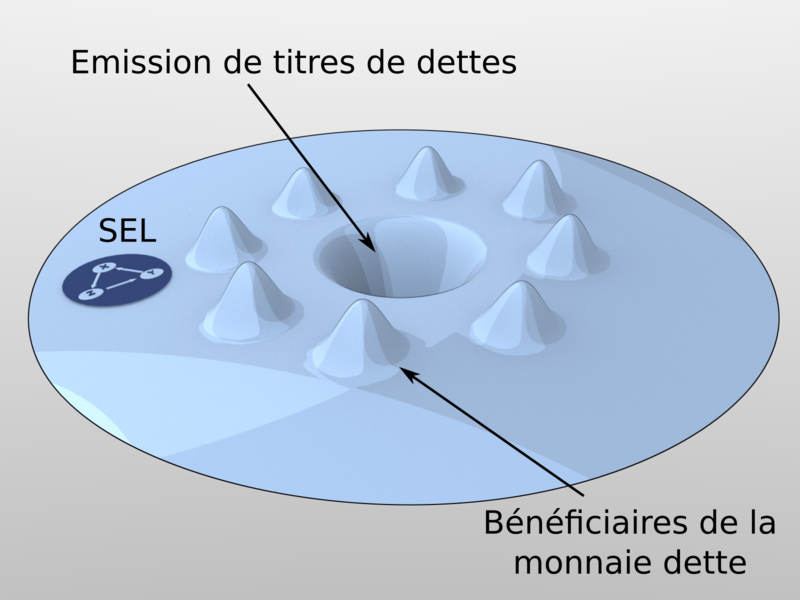

The Value Field of Debt Money

This definition of the value field helps us to picture the evolution of economies based on the debt money system. The banking emitting center creates some debt money that will, then, diffuse little by little inside the economic zone till its edges.

The initial issue of debt is profitable to a first circle of economic actors such as banks, states (big consumers of debt money), and big companies. These actors consume most of this unilateral creation of credit. This sudden and centralized money issue will slowly depreciate the existing money available in the rest of the economic zone while it diffuses into it.

The name “money debt” is not enough to understand the mechanism because the debt issued is indeed never paid back. Only interest are generally paid which secure a perpetual annuity to the monopolistic issuer.

This centralized and asymmetric monetary system owes its perpetuation to its monopoly, and to the grant to more and more debts at a sufficient pace to pay the interests, but only for the first circle. The rest of the economy is being served in money but only in exchange of real production (from which the first issuing circle is abstaining), and thus is subjected to the monetary power.

The value field of a local exchange trading system “LETS”

LETS (Local Exchange Trading System) are developing during cyclic monetary crisis, because of the lack of money, which blocks the economy and the exchanges which are far from the emission center of debt money. Communities having a pseudo-autonomy on generally limited fields of activity, develop then a complementary symmetrical currency, partially freeing them from the central currency.

LETS are creating most of the time a symmetrical model of mutual credit and do not create any distortion regarding the money created inside the economic community. Being created on the basis of a complementary money, their trades are not officially recorded in the official economy, and that is a substantial part of the GDP which escapes from the evaluation of the economy, because of the non-density of currencies with asymmetrical issuance.

The value field of non monetized production

Non monetized production, because of the total lack of central or local money, appears in the field of value as a hollow: (money = 0) - value < 0. It is the case for all production that is traded, given, produced without merchant exchange, which includes most of free softwares, free of rights works, and any voluntary service, which substantially benefits monetized economy.

One may wonder why producers would be giving away their production without any monetary return. The reason is that some values are especially important as they disseminate fast, widely and freely, enabling the establishment of usages, norms, and recruitment of new producers bringing their modifications to the community.

The total value of this type of production exceeds by scales of magnitude the value of the listed companies in this sector, when we estimate the equivalent development cost that would be needed to produce the same thing. One should simply think that in 2010 all the Internet is running essentially on free layers, in terms of protocols, servers, databases...

Even Science is most often the subject of free of rights discoveries. Scientists inventors are most of the time lead to publish their discoveries to get peer reviews, and it is a collaborative work both in time (scientists from the present are benefiting from past discoveries) and space (discoveries being most often the result of a common work). One can wonder for example how much Einstein could have benefited from rights on “intellectual property” on the Theory of Relativity. It would be interesting to estimate, to know what the guy created in “usual” economic terms...

It seems that software and artists producing free software and free works did not yet bother to integrate the monetary tool within their community, and that remains a mystery, even if the revelation of the mystery of money is not straightforward, it is typically similar to algorithms and games, which are domains mastered by this community. Though, software letting a community establish its money already exist, and they can be deployed fast.

Non-monetized production can totally be huge in terms of value and is arbitrary ignored from an arbitrary center of “debt money” issuance which only monetizes what it knows, therefore denying the second economic freedom. (Luc Fievet RTM 2.0)

However, to balance this sad observation, which is probably temporary, we can remark that big communities created around playful activities like Second Life or even more without any doubt World of Warcraft, have created a powerful monetary approach. Here, the internal money of the persistent world of WoW, is not created properly, but is still accessible via normal actions in the game, they are subject to external transactions, including in official currency. This shows without doubt that as soon as a currency is created within a community, its value is revealed, and not the opposite.

Therefore, because there is no circulating money inside these communities creating free values, the value of these works is not defined. While in the meantime the monetary creation inside a gaming community spontaneously reveals a measurable value. Thus, money is not only a trading tool but a common measure tool as well. We can not measure economic value in an area without money. Such big misunderstanding of this mechanism leads economic policies to rely on data like the PDB, which only measures what is monetarily irrigated, creating bubble and resonance effects, and financing only the past from debt obligations on the future, and never the future on the basis of a Dividend on the past.

The huge non-monetized value has a role to bring big monetary creation forward, which exceeds by far the sum of old values on which already existing money circulates. This is the productive basis of big historical inflationary bursts: the violent creation of debt money whose purpose is for the issuers to fraudulently monopolize the new economic replacement value.

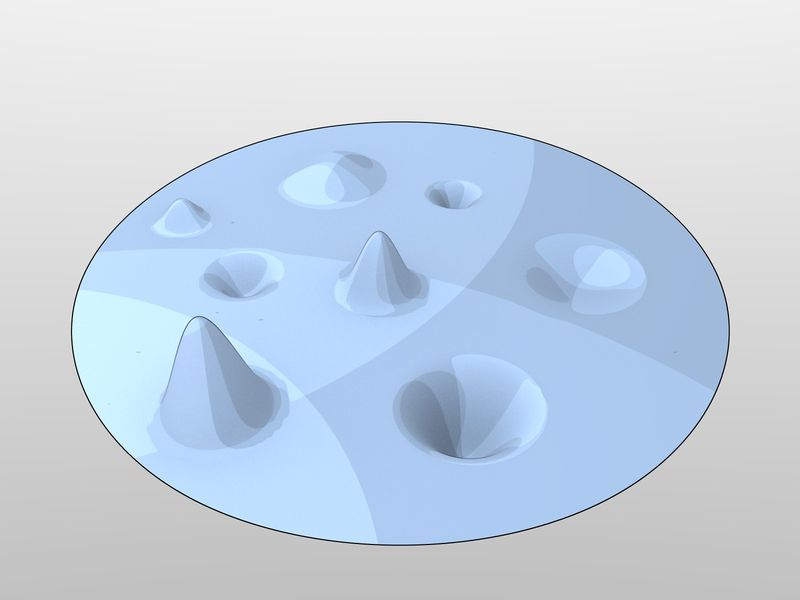

The Value Field of a Universal Dividend Economy

A Universal Dividend economy equalizes monetary creation. It does not stop hollows and bumps from appearing, but it makes them possible everywhere, without any central point, and most importantly bringing a money circulation in all the economic area by its intrinsically dense structure, which limits the points and the accumulation duration, as much monetary as productive.

In this type of economy there is no central point of monetary issuance, which makes every project, every production, and every autonomous economic circuit directly exchanged for money everywhere and at all time.

In a monetary field of debt money, far from the issuance center, we will find these type of structures, but at a scale too weak compared to central distortions, which makes it appear as flat (negligible distortion) seen from the center. The problem is that the force of attraction of the false central debt (and real asymmetrical and fraudulent monetary issuance) which provokes unstoppable fights to free oneself from it.

The Forces in Place

The value field has a tendency to oscillate around its equilibrium point. Also a hollow will have a tendency to rise until it attracts existing money, and if it is not enough, to provoke money issuance (until it causes the creation of a local complementary currency). In the same way, money will have a tendency to accumulate until it causes the purchase of non-monetary values. Hollows and bumps are then two masses attracting each other. This phenomenon can be seen at any measure scale, from the individual to the whole economic area, and the process of filling hollows with bumps is unavoidable, be it discrete or continuous, fast or slow, peaceful or violent.

In a central system of debt money, centralized accumulation of money or production is done until a break point is reached where the attraction force of the excessive surplus of money compared to the excessive surplus of non-monetized production triggers a brutal movement. Thus in general hyperinflation of prices where production was under-monetized for too long, which develops with the influx of money freed from the center, or movements such as the shutdown of production because of the lack of money or any form of compensation for too long, which can lead to historical social crisis, revolutions or wars.

The chosen (or forced) monetary creation system defines the type of economic development that follows, as well as the space-time form of the value field: a continuous fluctuation without interruption for a Universal Dividend system, or pyramids of central money with cyclic crushes (monetary bubbles, also called speculative bubbles) for asymmetrical issuance systems.