Focus on History of money

In this chapter, historical and consecutive monetary periods are analysed according to the relative viewpoint of the RMT. It does not pretend to be an “absolute” viewpoint.

The Neolithic currencies, first dense currencies with uncontrolled inflation

From the Neolithic, we find equivalents of exchanges accounting by material barter based on diverse reference values. In Britain for instance, we found in the tumulus built at these times, important stocks of axes made of jade, which number and dissemination resemble strongly to monetary stocks, allowing trades based on a value of reference.

With this type of accounting, yet the possibility of a monetary inflation were existed, due to those who has access to stocks of this value of reference. This explains undoubtedly that such important stocks remains until our era.

Metallic currencies, first currencies limiting inflation

Barter being insufficient to allow exchanges, and the first currencies based on potentially and strongly inflationary productions because easy produced by anybody, it became necessary to use a money value more stable. To do so, rare metals were going to take the central monetary role advantageously.

This is how gold, silver, bronze and copper are going to be used as almost exclusive value of reference during the empires developments from Antiquity, and this until the 18th century, beside the strong development of paper currencies.

Roman Empire

No empire without monetary expansion! The universality of the use of currency gives to the one who controls the production and the definition a great power of illegitimate monopole when the respect for ethics toward the emission is not at the core of the fundamental values.

Roman Empire comes with monetary expansion, regularly “devalued” for the benefit of one central issuer: Rome.

Denier, Sesterium, Aureus, Antoninien, Valerian, Argenteus, Solidus, follow one another. Made of bronze, copper, silver and gold according to the conquests by force, and to their gains, or via the slavery in auriferous zones, as the famous region of “Las Medulas” in Spain, where - according to the narratives of Pliny the Elder - we can consider that between 26 BC and the 3th century, Romans extracted approximately 1 500 tons of gold.

Each of these currencies is emitted while an expansion of the Empire occurs, and during the appropriation of metallic resources, replacing the former, then it’s slowly devalued by the central issuer which puts less and less noble metal in the coins, obviously due to not having access to infinite resources.

The solidus, based on a fixed gold quantity is not abandoned by loss of value, but by rarity. It’s not its value that makes it lose its status of currency, (it still has value nowadays!), but its universality as intermediary of exchange which cannot be assured.

Yet, we can think to the fact that although monetary unity devalues itself - according to the reference material which is represented during its first emission in time - it doesn’t impede the economic expansion and the global quantity that can be exchanged by the whole monetary mass - which is increasing in time. There is no contraction between the unitary contraction of money and its global expansion which comes with the economic evolution.

We can sum up this by the fact that 1 is way smaller compared to 1000 than compared to 100, while 1000 is way bigger than 100. If doing so, our monetary unity loose 10% of its exchange capacity in relation to a given value, and at the mean time, the monetary mass gains globally 15% of exchange capacity - due to the economic expansion that comes with its transformation - then, what is “lost” in unit, is “gained” globally. Remains to know where the noticed surplus comes from.

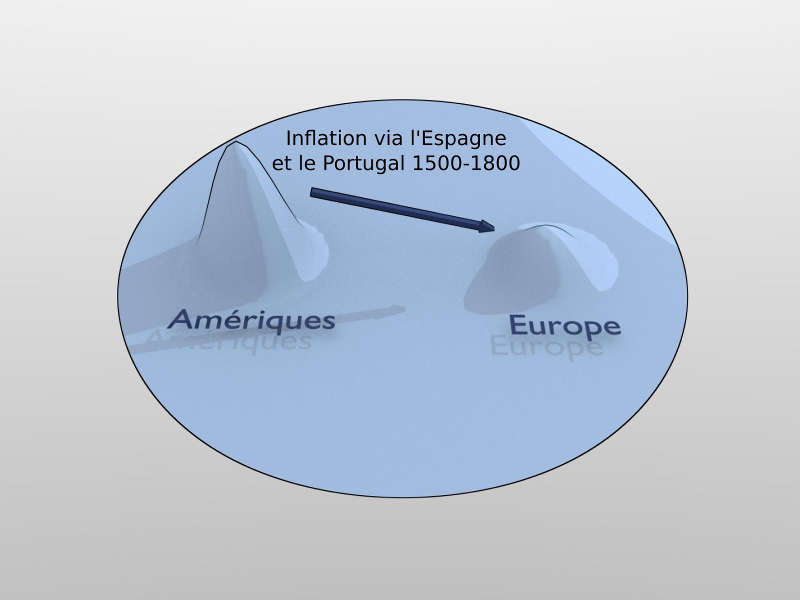

Golden and silver Spanish bubble

Despite their limited nature, gold and silver didn’t avoid inflation, mostly during the Spanish Empire time (from the 15th century). The discovery of Americas by Christoph Columbus (1492) turned upside down the monetary streams in Europe.

According to Wikipedia “Economic relations between the Spanish America and Europe” (in French only):

” The two big battlefield loot done during the Aztec Empire and mostly in the Inca Empire, brought back important sums of money to the spanish crown and to the conquistadores. The Inca emperor Atahualpa’s ransom represents, according to Pierre Chaunu, half a century of precious metals in europe.

Mines bring back even more spoils of war : first of all, thanks to few sources of gold in Cuba at the beginning of the 15th century, then thanks to the big silver mines from Peru in the 17th century (mine from the Potosi), and more in the north, Mexican mines dominate the production from the 18th century with the gold mines from Portuguese Brazil (Minas Gerais).

It’s during the 17th and the 18th centuries that precious metals’ production and arrival in Europe have been the most important.”

But what do we notice? Precious metals loose their value all along centuries: according to the historian Earl Hamilton and his “Price History”, the stock of 600 millions pesos in 1500, allows to buy as much wheat as the stock of 3 billions in 1800.

Addition of money in economy decreases the value of money. What is true for a gain of any product’s productivity (fall of its monetary value regarding a constant money) is also true for money, even though it’s about a good of reference: the quantity of merchandise that can be exchanged with a certain quantity of money, depends on the total quantity of currency in circulation. Therefore, it’s not one or another but both. The productivity’s growth of production of wheat would’ve decreased the price of the currency, here in gold or silver metal all along the 3 centuries. However, the constant addition of an important quantity of money which has been spread into the economy (estimated here according to Hamilton to 5 times more), would’ve increased by 5 the price at constant production and consumption.

Supposing a relative stability of goods and services production between these two dates, we would have the right to pretend that the cost of the wheat production decreased by 5, meanwhile the injection of 5 times more of money stabilized the facial price.

This short-cut doesn’t reckon with the changes of economic behaviour, with the growth of the numbers of individuals (which reduce the part on currency/person), with the new goods and services requiring their part of the monetary stream, etc... But it allows to understand well the mechanism occurring within the money system : the local price relies strongly on the global monetary variation, as well as its density of distribution. The density has to be understand as so : if the surplus of money was stayed in Americas, the price of the wheat in Europe, according to the same reasoning, would have fell from factor 5, essentially due to the gains of productivity made, and any other things alike..

This historical note allows to understand that not only gold and silver don’t escape to the fundamental relative monetary rules, but it’s not require to use them to manage the common monetary mass. Thus, it’s not the nature of a determined good which makes it a currency, but the agreement of any mode of circular exchange and also purely mathematical. So how this currency will be managed? It’s the trust regarding the ethic of the tool of exchange which will ensure the membership of Citizens to the proposed currency.

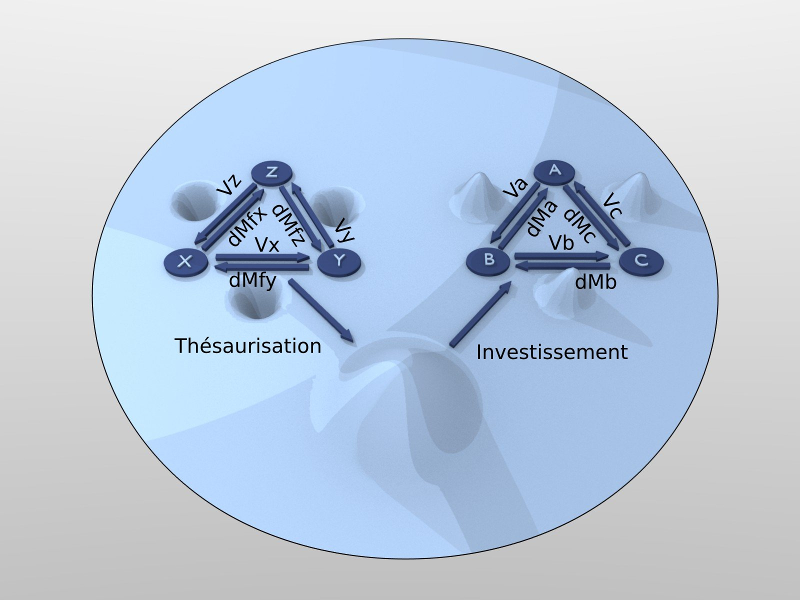

The collapse to avoid : hoarding and deflation

Considering their growing monetary role, golden and silver metal were going to push to the seek and control of deposits, as well as hoarding. Lending currencies at fixed interest rate, creditors involve borrowers to give back more than what it exists in circulation, in a global movement of hoarding. The limited nature of this type of currency makes impossible technically this type of flow of funding over the longer term.

We have to understand that the phenomenon of lending is already in itself a hoarding phenomenon, the lender await to gain more money than what he owns, and it has nothing to see with the role of the currency as an immediate mean of universal exchange of goods and services. It’s not a problem as long as the lending and the hoarding remain limited, but what happens if the currency is excessively hoarded or leaks aren’t progressively bailed out, as we have to add energy in an isolated system in order for it to keep moving?

We have a phenomenon of dissipation of the currency. Not only the hoarding creates a deflationary cycle when the money creation does not compensate the loss, but the idea which says that saving is good because it presupposes an upcoming investment, is insufficient to explain or to stem the mechanism, for two reasons:

If the savings accumulated is re-injected in the forms of loans, the deflationary cycle will go trough a temporary counter-tendency, and the accumulated savings, if the borrowers continue to refund correctly increase, increasing the deflation rate to levels of price decline so insupportable that the bankruptcy of the exchange circuit is reached. The lender who has an initial monetary advantage, and gets some fun by only injecting money in the form of loans, and not in the form of circulating goods, takes mechanically possession of the whole economic circuit.

if the accumulated savings is invested in another autonomous trading circuit (in space or in time), this is really good for this new circuit without any doubt, but it will do nothing on the problem of the initial circuit, which does not necessary have the goal or the means to sell its production outside, for example where this money would have been invested. Here again we perceive the fine analysis enabled by the field of value, which removes inconsistency of global theories by focusing on the density of money and the differential field of value.

Still this local deflationary mechanism is all the more dampened in a money of rare reference value which, by construction, not only is not dense everywhere, but also of which the growth depends on external parameters and specific investments to produce, which lacks of relevance with what the free producers want to produce and trade regarding the measure of any value.

Low growth money but dense encourage investment and plays then its fundamental role : money usage for trades inside production circuits. Moreover it can be used to restore progressively monetary density everywhere, by repairing slowly but progressively and without bumps, unavoidable leaks due to excess of hoarding or external investments of the corresponding economic area.

Finally, paralleling with the physics is not without interest. We know since energetics theories that the perpetual movement is impossible. The perpetual movement consist in a system which would turn on itself, with a initial input f energy finished. Yet these systems violate the first and second principles of the thermodynamic. To be clear, there is always energy loss, and it is necessary, one way or the other, to inject supplementary energy to keep the system moving.

To bring an interesting historical footnote, Albert Einstein declared that he when he was working on his Special Theory of Relativity (from 1902 to 1905), he was working for the patent office of Berne, this work was “handy” for him. Indeed, besides the fact that it was giving him the necessary livelihood to pursue his scientific researches, this work was not wasting too much of his energy, and consisted most of the time to declare as inadmissible the patents which pretended to realize perpetual movement machines.

To think that a fixed quantity of money would be a guarantee of stability of the “value” of this money, is to not understand the Relativity of the individual measure of value, and not to take into account neither the simple experimental fact, which demonstrate all along money history for 10 000 years, that forced or conciously accepted the expansion of monetary masses is unavoidable. By understanding this phenomenon we will transform the cyclic changes of catch-up brutally experienced, mostly sources of war or revolutions, in simple adjusting periods, acceptable because well understood by anyone, based on a systemic ethic clearly defined, hardly questionable, and always ensuring the economic freedoms.

John Locke 1632 - 1704

John Locke, philosopher precursor of the age of the enlightenment puts limits and tempere property rights by the “lockean proviso” which declares that one can only claim legitimately the ownership of original resources where there is enough, and as good, left in common for others.

Fiat currencies, first expansionist currencies

In the 18th century, the “Law’s system” - from the Scottish “John Law” - is officially implemented within a central proto-bank in France. Law observed the monetary fiduciaries mechanisms which were already working in Italy. Then France was overwhelmed by debts and Louis 15 gave his agreement for the implementation of this system.

Fiduciary money engenders a currency which evolves toward a loss with the referent value, to go toward a dematerialization in the form of pure trust. This very first version of money paper represents a part of the referent value (gold or silver) payable by the issuing Bank.

First fiat pyramids of centralized creation

The first banks issuing fiat money base the trust on the reference value. But the temptation to print more banknotes than the Bank owns in metal as a guarantee, enabling more and more actors to monetized their production, and thus to create value exchanges cycles. The economic development is fastening as money becomes more dense in the economy.

However, two fundamental causes provoke the collapse of these expansionist pyramids.

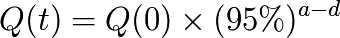

First of all one can not indefinably guarantee fixedly a finished value of reference by emitting more and more money. It would need to announce clearly the growth rate of the money emitted by the Bank, would allow getting a opposite rate of value of reference in time. For example, banknotes are emitted at a speed of “c”, guaranteeing a value of reference owned by the issuer, and it is announced that the banknote at the time of issuing, the banknote is exchangeable to a quantity of value of reference, then this banknote should be noted that at time “t” the exchangeable value of reference will be :

For example for a displayed growth of banknotes issued of 5% / year, it should be noted on the banknotes issued at the date “d” that the quantity of value of reference guaranteed by this banknote for the current year “a” is :

The quantity of exchangeable value of reference would halve in this precise situation every 15 years after the issuing date of a banknote. This system would be complex, and would ask to do the calculation of the value of reference for every banknote depending on its issuing date, but it would be exact.

The second cause is the loss of trust in the fixed guarantee. Existing banknotes being guaranteed by a fix value, with a very big trust of its users, the guarantee is almost never claimed by the beneficiaries. The Banker starts to feel exhilarated, and issue more money, then more again, until the day where the trust drops.

Actors of economy are surprised to find so much guarantees of the referent value in their trades, increasing so the price in the emitted fiduciary currency, until the day where the trust in the issuer ceases, which constitutes the rupture and the crisis. Requesting for their guarantees, beneficiaries find out the truth : the equal quantity of the referent value, according to the the sum of the emitted wages, doesn’t exist in the bank, customers are swindled and it’s bankruptcy.

This is the principle of the Ponzi pyramid which is described here and where it’s the last participants who are the most hardly affected. It’s due to the fact that an economical expansion can’t be done upon the wage of a fixed referent value. This phenomenon, which seems obvious, will take 3 centuries to find a partial improvement, when fiduciary money will take place more and more in the economy as itself and not as a guarantee.

The phenomenon of Ponzi pyramid - consisting in making the last participants pay to remunerate the first ones - in the monetary mirror of the value, means spoiling goods or making the last participants work for the benefit of the central issuers of money.

Thomas Paine 1737 – 1809

Thomas Paine, revolutionary American, then French, declared in the “Human rights” published in 1792 the following assertion:

“Those who have quitted the world, and those who have not yet arrived at it, are as remote from each other as the utmost stretch of mortal imagination can conceive. What possible obligation, then, can exist between them- what rule or principle can be laid down that of two nonentities, the one out of existence and the other not in, and who never can meet in this world, the one should control the other to the end of time?”

In 1785 three years after “Human rights” Thomas Pain, then French deputy, publish “Agrarian Justice” in which he declares that no citizen without revenue can be and as any citizen has to be represented, he must benefit of a universal basic income allowing him a political existence.

Invention of regulated Leverage

Despite repeated failures of the first Central Banks, the idea of an expansionist fiduciary money was never abandoned. Why ? Because such a money is easier to transport, easier to exchange, is a nice business model for issuing Banks, but most of all it lead the economy to fast expansionist periods. A system where failure were avoided had to be found while saving the positive aspects of this system.

A solution has been found: the limited banking leverage. The banker has a limit of fiduciary money emission in the limited of a regulated ratio. This system would allow customers to find back the referent value in a sufficiently high proportion, in order to not undermine the trust. Historically, it’s about factor 10% of reserve which has been chosen. This reserve ratio, a sufficient numbers of customers could get back their referent value and the trust remained valid in the system.. Only for a longer time!

This system still asymmetric does not impede the loss of trust and only postpones the term on a larger period. The limited leverage effect is finally blocked while it reaches the “long-term assets”, when the 10% of reserve are reached, the banking system is forced to stop emitting new credits, and it’s bankruptcy for the last borrowers who can’t expect any more stream of the new currency which allows to pay the debts and the interests.

The referent value guaranteed by money can’t be respected by the issuer who wants to allocate more credits to reinforce an economic expansion. Beside, without monetary expansion, it’s not possible to reinforce the investment, the hoarding without associated value creation, sufficient to acquire a growing buying power. The intrinsically melting value of an expansionist currency encourage its circulation, allows to pay debts + interest: it is the necessary condition for a supple expansion in time.

Playing on these both complementary aspects which are expansion and credits contraction, the centralized system with leverage effect, give to the banks, the control of the artificial “economic cycles”, which are only monetary cycles, allowing not only to control the whole economy but also to ensure - whatever the created value - a perpetual income. It’s a fact: issuers of asymmetric money are among the oldest economic centres of activities with the States, which take the successive “crisis” in stride.

Producers remote from the monetary emission centre - misunderstanding how money is emitted - realize belatedly the effects of the politics of credits emission over the fluctuation of the common money value, and they measure too late the impact of this phenomenon on their own activity.

When they realize it, and all wish at the same time to recover the “reference value” there is not as much stocks for answer to all demands (insuring 10% of reserves remains in any case a fraud, it is impossible for the whole owners of money to recover this “value”, and the first to get it are doing it at the expense of the others before general bankruptcy), and the bankruptcies from Banks to Banks destabilize then all the rest of the economy which collapses and leads to social and political disorders of historical scale. 1929 was the last crisis at an international scale based on a value of fixed reference.

Clifford Hugh Douglas 1879 – 1952

Clifford Hugh Douglas, British engineer published in 1924 “social credit” , where we see for the first time the perspective of a “monetary dividend ” which is demonstrated as essential to ensure the balance of the money and the correction of the bias of interests related to debts.

The instability of the reference value

From 1946 to 1971, the gold standard continues to be used, but it is not really guaranteed by the transmitter other than through façade prices. As long as the demand for the reference value was low, the price could be displayed as fixed, but even before 1971, evolutions of the displayed price became necessary facing an excessive demand supported by the monetary expansion, as shown in this graph of the price in dollars of the gold standard, which was no longer one.

This is as well as since 1967, gold’s price started to letting go. Impossibility to provide baseline value to fix price within a money in expansion appear when at equal demand quantity of money growth. This is a purely mechanically phenomenon.

Similarly seen in 2010, a growth of 7% / year over 10 years of the money supply in euro, and then hear that “monetary policy” is to maintain a “2% inflation” is so absurd that we should not be surprised to see coming sooner or later a violent catching, either by blows on the most requested values, or gradually, but it would be mechanically impossible on the long term to get two totally contradictory figures.

Complete abandonment of the gold standard, the fractional reserves

Recognising the futility and the impossibility of holding a standard through a reference value, 1971 sees the emergence of fractional reserves, a control system of the money supply by Central Banks, which allows to control interest rates and the amount of funds allocated by the Banks. The price of gold then underwent various changes, through a historical bubble that saw a peak in 1980.

The system of fractional reserves still does not solve the problem of ethics as to the currency, a two-headed emission centre, Banks and States, in arrogating to a monopoly of exclusive emission to the detriment of producers away from the centre.

There is always, in this system, a leverage which takes advantage of the asymmetrical issuer of the currency that creates money by arbitrary credit «pledged», in case of bankruptcy of the borrower, with a rate such as 8% of reserve.. made of.. the same currency! This change is a windfall for the financial sector, since this type of reserve is being manipulated easily, one can always, in case of crises, find solutions, which can be ethically very questionable, but allow to avoid sudden failures and thus avoid a part of previous disorders.

We can compare the monetary system still active in 2010 to the old French computers network of the Minitel, a centralized network, where the creation of services required a review of the monopolistic owner and the sharing of revenues from the activity. While an issue system of symmetrical currencies in the space-time such as Universal Dividend is comparable to a neutral Internet where every citizen of the economic zone is considered as equal to money creation, and therefore capable of exchanging in “peer to peer”, from person to person, without special permission of a central authority.

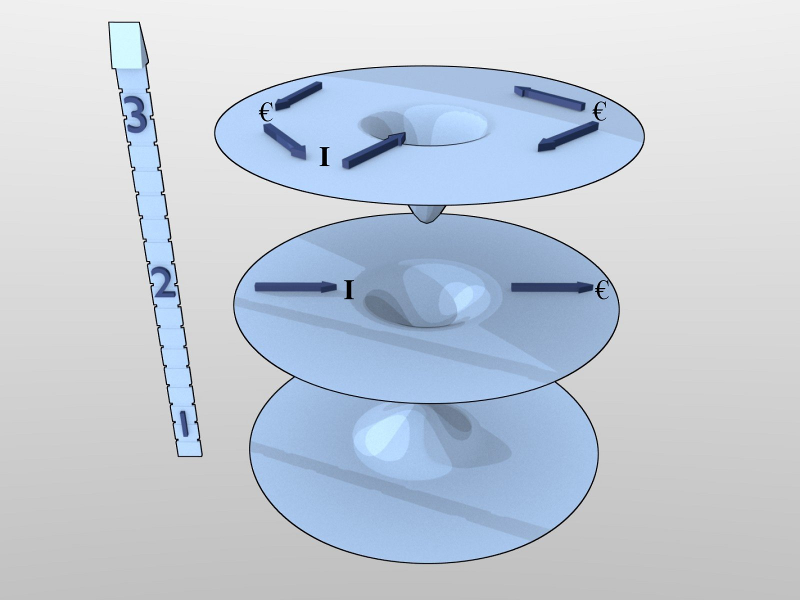

How does this fractional reserve system work in terms of the economy ? This system creates artificial cycles for the benefit of asymmetric issuers :

Step 1 : The financial system is being consolidated, and on the basis of his “own founds” will be able to issue a debt “€” via interests which comes “irrigate the economy” by a “leverage”. Step which can be long and sprawls overs 10 or 20 years, the Central Bank ensuring a control of this “regulatory spoliation”, at a low enough rate to be sustainable.

Step 2 : the financial system “is paid” by the interest “I” of the issued debt (public and private). The interests, and possibly the nominal debts, fueling the “hole” thus formed. Except that the issued debt has no reason to “return” to the issuer, as having duly paid this or that, it is very largely hoarded by investors, or is found circulating in autonomous microsystems which use rightly medium of exchange. This step can also last for 10 to 20 years ...

Step 3 : due to the impossibility of return issued debt with interests, the financial system, on the basis of caused bankruptcies, end up with a totally unstable balance, and in a bankruptcy itself (it is still expected to balance its balance sheet). He collapses on itself. There is then a massive issuance of new debt “to rebuild it”, to irrigate again an economy that moves away (inflation of real wealth) but lacking sorely of money (crisis due to the scarcity artificially maintained of the currency). It then finds the end of the cycle and a new cycle may restart, 1) 2) and 3), except that considered economic space is much larger and “richer” than in the previous cycle (in monetized value which does not mean an “absolute” value, which does not exist).

The result for the producers, is that, regardless of the created and exchanged value, the acceptance of such “common” currency is the assurance that this value will inevitably vampirized by the asymmetrical issuer, assuring him a “business model “absolute and infallible, valid at any point in space-time.

Yoland Bresson, born in 1942

In the “post-wage-labour” published in 1984, the french economist Yoland Bresson states :

“The community needs, through the State, to periodically allocate to any economic citizen, no other considerations than its existence, the monetary equivalent of the value of the unit of time”.

Yoland Bresson demonstrates a relationship between time of existence and value, and calculates, on considerations relating to GDP, a relative value of a basic income (named “revenu d’existence”) whose quantity is surprisingly close to that deduced by the purely monetary and relativistic approach to the RTM.

2010 and after : Bâle III, or symmetrical currencies ?

The cycle being long, the capturing value is being made on a sufficiently low rate to not be excessive, the process is hardly discernible. In the same way, who is able to see the difference between building a network centered, such as the Minitel, and building an acentric, symmetrical and neutral network, such as Internet, except for system administrators and telecommunication protocols specialists ?

We are therefore in the exploitation of ignorance as to the construction of the monetary system. An informed citizen of a proposal for the use of a common currency allowing it to trade fairly with similar production present and future, should not accept such an architecture, but opt for a choice that is open, transparent, and equitable among all members of the respective currency union.

2007 – 2010 representes the end of the last cycle of monetary expansion 1971 – 2010, which has seen successively private rules prevail both in the USA and in Europe, decided within an “expert” group, named “Bâle I” then “Bâle II” and “Bâle III” under negotiation, expected “regulate the Banks ”.

This would be like trying to transform the Minitel while the Internet is being increasingly adopted.

But what’s happening in 2010 ? An explosion of complementary currencies ever seen in the history of currency crises. If the local currencies explode, attempting several types of monetary systems, based on a fixed mutual credit, with an Universal Dividend, it is mainly on Internet that are deployed interesting attempts, which the most technically accomplished is probably the Open Source project “BitCoin” which allows to manage a monetary system P2P “peer to peer”, where the currency can develop itself in a fully decentralized way, through peer-to-peer relationships and where all transactions are stored and encrypted on the entire network.

The project Bitcoin is however sealed by a non-fundamental compatibility with RTM. Indeed the total mass of Bitcoins is technically limited to a maximum. So that although the spatial symmetry is respected in part because it seems not to advantage anyone, the temporal symmetry is not, and once past the generation of the maximum money supply, the last new adopters won’t have access.

In addition there still is a spatial bias. The symmetry is not based on individuals adopting the system, but on the machine ability to generate computing. This is not consistent with economic freedoms. Bitcoin therefore doesn’t respect the first freedom of a monetary system, as it is an open system.

Therefore it can be expected that the “temporal pyramid of Bitcoins” collapses sooner or later.

What remains from the gold rush, except ghost towns ? Whereas after a harvest, a wheat field does not provide over and over again abundant crops ?

The Universal Dividend implemented

The Universal Dividend has already been implemented recently under different forms, and under different names as “unconditional basic income”, “basic income guarantee”, “universal basic income” etc...

There are examples of implementation in Alaska, in a local experience in Namibia, within SEL as SCEC in Italy, or in Brazil. There are groups that promote a symmetric and individual income as the International Association of BIEN (Basic Income Exchange Network), as well as the AIRE (Association pour l’Instauration d’un Revenu d’Existence) in France was chaired by the economist Yoland Bresson.

Best of all, Europe is already virtually installed in a system where an Universal Dividend grew since 20 years, in parallel with a system of arbitrary credits. In France, in 2010, the RSA is 450€/month, but it decreases gradually as assured people gain additional revenues, on a large ditch, so that for example, among citizens earning an equal hourly income, some touching the RSA by working only half-time, when others are full-time. A totally unfair system that can be called “great divide” and whose main consequence is to encourage citizens with little income, not to monetize their productions, or not to declare the exchanges (or both).

This is actually all OECD countries that offers a minimum income, which remains conditional in most cases, usually associated with an age requirement, various constraints such as to demonstrate the search of a “job”, and thus ultimately they do not consider individuals as unconditional associated with the nation.

The main problem of the euro zone is the strong disparity of the minimum income. Where France, Germany and Spain offer more or less comparable amount of 450€/month, the citizens of other countries recently associated with the common currency don’t have, and sometimes have minimum wages below this amount.

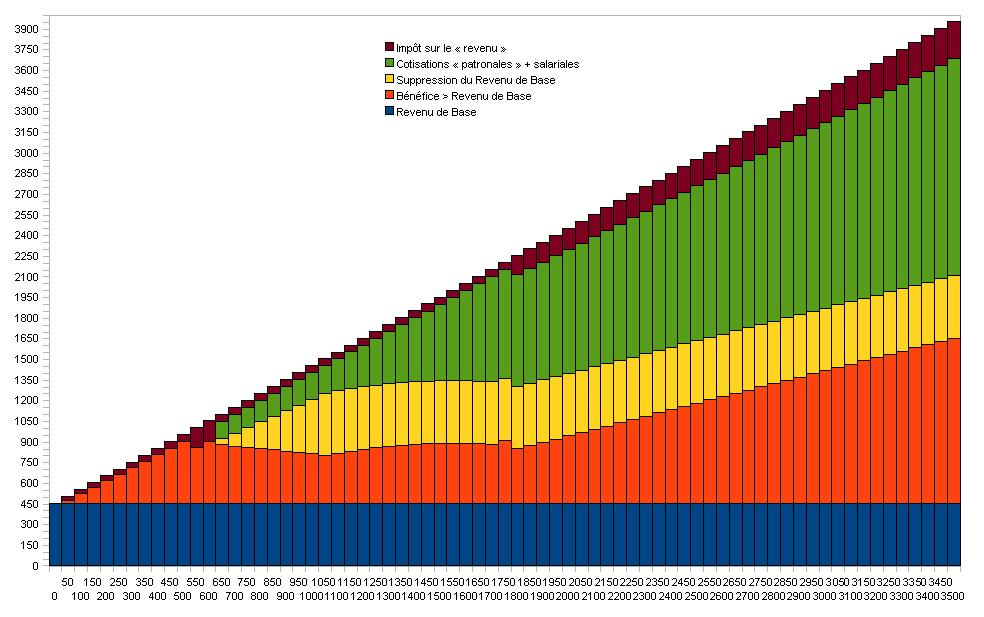

Evolution in France in 2011, of the net revenue received (blue areas + orange = RSA + net complement. The yellow areas, green and red are the taxes) According of total individual turnover or full salary (abscissa = full salary). Between 600€ and 2200€ / month of turnover, The Citizen earns always the same amount, about 1050€ / month. (http://www.creationmonetaire.info “The basic income in France”)

Under these conditions, the production leaves the countries offering high minimum income to reach out to those where it is much lower or non-existent, creating a strong distortion of competition between individuals, in total contradiction with the stated objective of a free market and undistorted .

A common currency is only compatible with human rights if its mode of creation respect the equality of men before the judgment of any value, and thus their equal right to the money creation. The implementation of an economic zone based on a common currency, without a convergence of individual minimum incomes, is a violation of law. It comes to an implementation of a currency that doesn’t respect the four freedoms (the freedom of the democratic change in the code, and the three economic freedoms which are the access to resources, the production, and the exchange “in the currency” ).

The open project Open-UDC

The project Open-UDC ( as “Universal Dividend Currency”) is a development project of an open computer system ( licensed under GPL ), of free currencies based on Universal Dividend.

Initiated in 2011, it is accessible on http://www.open-udc.org , and it consists to develop a set of tools allowing the individual and collective management of monetary exchange within of a digital money supply associated with rules and open and democratic control processes.

Besides an initial democratic basis, the project has reduced the calculation of the Universal Dividend on a monthly basis from very simple rules, it may be useful to remind here for the creators of local money wanting to follow the RTM :

- UD (0) = 100 UDC

- UD (n+1) = MAX { UD(n) ; Pud × M(n)/N(n) }

Where “n” is the previous month. UD(n) is the Universal Dividend of the last month, Pud is the constant percentage of the preset minimum Universal Dividend, M(n) is the money supply of the last month, and N(n) is the number of members of the monetary community.

The Universal Dividend in monetary units and thus fixed, never fall, and is recovered if the growth of the money supply for each member (M(n)/N(n)) becomes lower to the minimum “Pud”.