How to set-up a currency based on a Universal Dividend?

A Universal Dividend based currency can be set up based on a new currency or on an existing one following two approaches, simple or progressive.

Simple approach

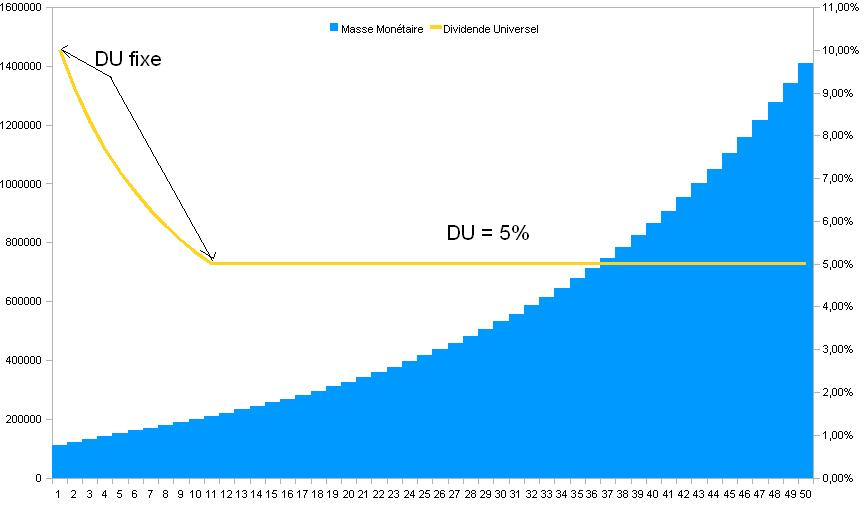

The first approach consist in setting up an initial Universal Dividend superior to the “c” rate target that we will leave unchanged until the monetary mass growth rate reaches “c”. From now on, we regularly increase the Universal Dividend by following the “c” rate. This approach is particularly suitable in the case of a preexisting currency that mutates to the Universal Dividend.

For instance, in the Euro Zone, this approach could be performed based on the existing minimum allowances, grouping all social help within a unique and simplified counter, and integrating in the preexisting salary the mention of the Universal Dividend in the gross wage. It could be a “motionless revolution” which would essentially consist in raising the awareness of the Basic Income as the base for all free economical activity based on the sovereign individual, taking all his full part in the monetary system.

Progressive approach, the European case

The second approach consists is allocating to each new member a fixed initial credit associated to an optimal Universal Dividend from the very beginning. This solution is particularly suitable to create a new currency within a LETS.

Europe give us an very interesting case about a truncated Universal Dividend. It is truncated because a big part of the Euro Zone does not enjoy a minimal income, and that another part benefits from a conditional minimal income (hence not universal) and furthermore which is very high. We thus have individuals working for others with the simple application of an asymmetric monetary politic. Furthermore, conditions to get those minimal incomes are extremely complex, and require so much energy from individuals to ask for their part to different counters, that once it is obtained, it very strongly discourages monetized economic activity, which most of the time essentially results in the risk of coming out of the obtaining conditions.

The observed minimum income in France or in Germany is on average around 450€ / month (sometimes much more with others helps, but also much less if besides that the individual ventures to monetize a declared activity).

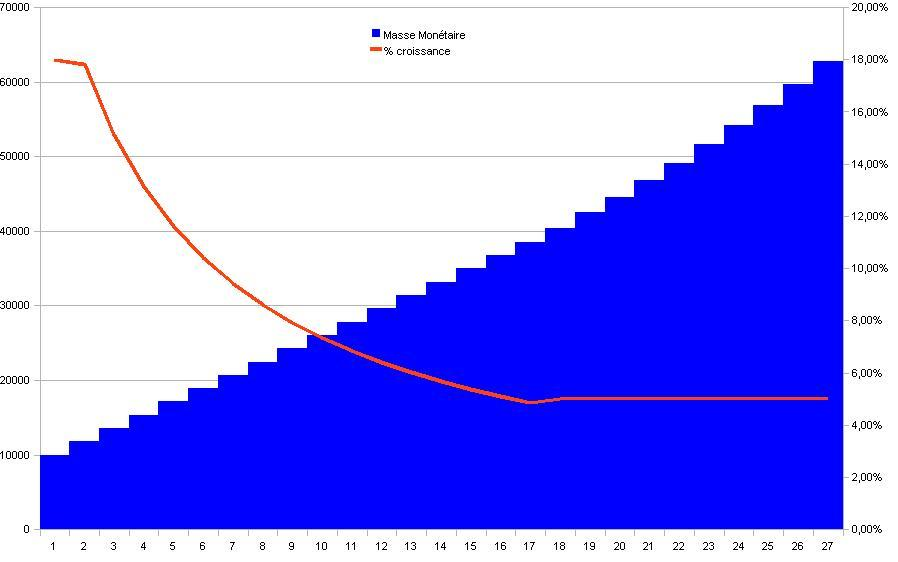

If the Euro Zone brutally declared this Universal Dividend level for 330 million citizens, this would be

at a 18% rate of the monetary mass, which, to fix universal dividend, could reach the optimal growth rate of 5% of monetary mass in 15 years.

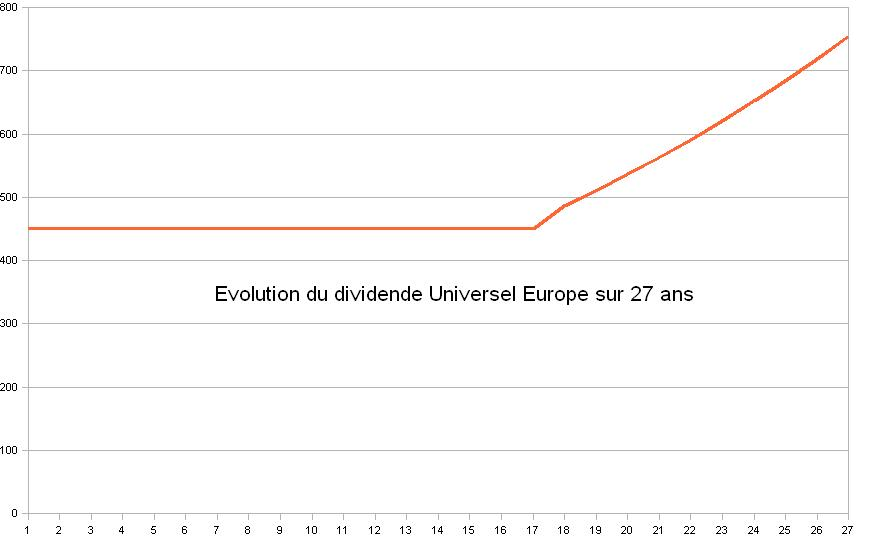

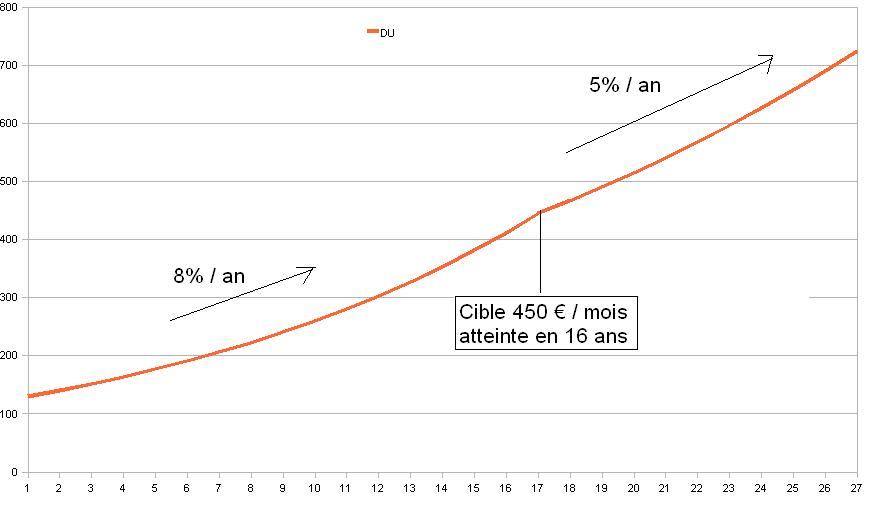

The Universal dividend itself would follow this evolution:

We could object that this evolution would be sudden, creating violent and sudden economical distortions, countries which are currently deprived in the zone of Universal Dividend being entitled to a new and high Universal Dividend could be quickly disorganized economically.

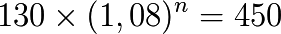

We can then imagine another more flexible strategy of convergence, starting from a Universal Dividend calculated from the 2010 monetary mass, of 130 € per month per individual for individuals deprived of a minimum income, to make it converge toward a target of 450 € per month per individual in the whole zone.

Basing ourselves on an asymmetric and strong growth of the Euro monetary mass observed at 8% per year from 2000 to 2007 (Law question: why did we allow a few to benefit exclusively from the monetary mass growth of common money to the detriment of other individuals?), we would reach this goal very quickly because:

equals to

The same duration as in the first strategy! (but creating less money, and so in a more progressive way).

The possibilities of progressive establishment exist, it is a simple question of fixing a defined spatio-temporal goal, associated to the recognition of equality between individuals of the same monetary zone before the measure of all value, and thus before monetary creation.

Reflection on loans with interests

Regardless of the monetary system used, it is right to think carefully about the problem of loaning with interest. If this interest exceeds the money mass growth rate, we are in a case in which we must recover more money than is created, what can prove mechanically impossible to realize, independently of all production and exchange levels.

If an autonomous but not insulated economical zone, whose local money was fed through an initial loan with interest, and then sees itself arbitrarily deprived of the associated money creation, then the creditor’s demand is to give back more money than there locally exists. Those cases are conditions of forced bankruptcy.

For instance in France in 2010, thought the monetary mass increased by 8% per year from 2000 to 2007, (7% between 2000 and 2010 due to the contraction 2007 – 2010), the 22% interest rate is a legal rate, furthermore applied to individuals who are the most remote from the money creation, so the less susceptible to be able to pay back. This is a sufficient condition to cause personal bankruptcy.

But let’s also take the case of a global monetary growth rate of 7% per year, with this additional money which is not symmetrically allocated within a zone, but only benefiting to central transmitters and their affiliates in the center of the global Ponzi pyramid. A local interest rate of 5%, although lower than the global growth rate, will be, in this remote place of from the emission, superior to the local money growth which will be for instance of 1%. Then it is at the moment of acceptance of this loan, a case of local decrease of monetary mass 5% - 1% = 4% per year, leading to local deflation and so to forced bankruptcies, independently from the notion of all production and exchange of values.

We might think that whoever accepts the loan should evaluate the ins and outs, and it is his responsibility to evaluate his “risk”, except that he is behind a Banking system which has access to all his accounts, and to global financial data. So, there is an asymmetric access to information, which allows one to take the advantage over the other. In fact the advantage of the money transmitter is immeasurable compared to the borrower. The first has all the information and all power to change it, the second has neither one nor the other.

With a transparent Universal Dividend, the long-term growth of the money supply being known and dense in the economy, the fixed interest rate of a money credit (of a previously accumulated money by the lender) should not legally exceed the Universal Dividend rate in order to have the insurance that the general conditions used to pay principal and interest are met. If the “risk” proves excessive for the lender, the solution is to not increase interest rate beyond the required maximal conditions, but to loan less or not at all.

At the very least this should also be the case in every monetary system. The interest rate of a loan can not legally exceed monetary mass growth rate. Without this, it is sure that conditions are not filled to be certain that it is possible to refund a loan at a superior rate, and such contracts must be logically declared inadmissible.

It is logically absurd that Law does not prohibit the emission of credits at an interest rate superior to the monetary mass growth rate.

Reflection on tax

The same reasoning than the one on the interest loan, implies that tax can NOT globally exceed the monetary mass growth rate, except if one wishes to give the State an unbearable prerogative over individual initiatives.

This means that in an Universal Dividend economy, community representatives, to finance collective projects with taxes must compute their estimates based on the number of managed individuals, and knowing the monetary growth “c” factor takes at most the lowest possible global fraction “f × c”. As for the rest, the State must finance itself by selling the goods and services it produces, and must not get into unreasonable debt given the normal influx of revenues it can obtain.