Reference Value Problem

The reference value is an old economic problem at the basis of many important crisis, due essentially to the misunderstanding of the “Three producers Problem”.

The reference value consisted in imposing to the actors a currency whose production was controlled by the producers of a specified property, for example rare metals, which obviously gave them a considerable advantage since they new how much money supply would be available for the future, as well as its control, at the expense of other actors who didn’t have this information, and then suffered the arbitrary shortage or overproduction of that type of money for their economic exchanges.

If on the other hand, and it is in majority the case, that reference value has no real utility in a pseudo-isolated economic zone, it has no other fundamental role than to quantify the exchanges, and can therefore be very advantageously swapped with a pure mathematical measure.

Some tenants of reference value object that at least with that value it is difficult to cheat regarding monetary creation, since one must add material value. This is false as history showed that even though it was based on a reference value, money has gone through inflationary or deflationary pushes, has caused bankruptcies and economic crisis because material “proof” has not been respected. It is not a matter of guarantee but a problem of transparency, trust, as well as ethical and equity respect, that are at the core of trust in a common money.

Also the reference value is not producible everywhere and at all times depending in its scarcity and exhaustion, which implies periods of monetary influx or scarcity, a phenomenon that doesn’t fulfill the temporal symmetry condition of monetary creation toward future generations. The generation that decides to adopt a currency of such nature does it at the expense of next generations, which will be imposed a money that has become rare and essentially possessed by the first entrants or their direct inheritors. It is a factor that blows away the freedom of the future humans by blocking their possibility to access resources to produce and exchange “in the money”.

Numerous direct proofs exist showing that economic values are not judged the same between successive generations.

Let’s take a specific example: in 2010, information technologies and telecommunication networks have taken a tremendous part of the globally exchanged value in the economy without common measure to what existed in 1980. But it would be a mistake to think we should today arbitrarily create more money insured with that value, since the value that will prevail in 2030 might be more fundamentally different after the judgment of the generation present at that moment. It would be simply like taking a decision in their place, although they are for the most already among us and manifest in their way their will to transform the economy from their own point of view.

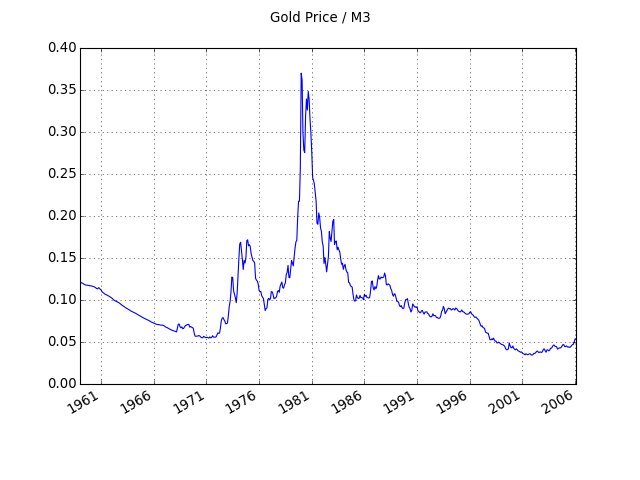

Another example taken in the past: when we see the relative value of gold, we can see without any possible doubt, for the generation of 1980, it was very clear that this metal was of a big value. But in 2010, and even if gold facial value has broken its historical records when compared to the total sum of the money in circulation, it weights less in the economy, while still being an exchanged value.

This doesn’t mean that this specific value cannot evolve to new relative summits, but rather that it evolves in a non correlated way from the issuance of the fiduciary money which is independent from it, at least partly. So, creating a separate currency doesn’t require any specific value, apart from the only one which is fundamental and universally present in space and time inside the economic zone: the human being.

Better: the definition of one reference value as a forced money is a fundamental bias that denies relativity of any value that any individual has the right to judge independently of his fellow citizens.

Also it is not surprising from the point of view of the Relative Theory of Money that in 1971 the standard gold has been abandoned for a totally dematerialized currency, whose growth is controlled by a Central Bank and by a set of rules restraining the capacity of the private Banks to emit credits.

However, the “money-debt” system, while being a step ahead from a system of reference value, remains biased by the granting of centralized credits on arbitrary volumes and values to the detriment of a large part of the present and future population.

“Ounce of gold / Money Supply M3 in the USA ($)” ratio evolution from 1958 to 2010.